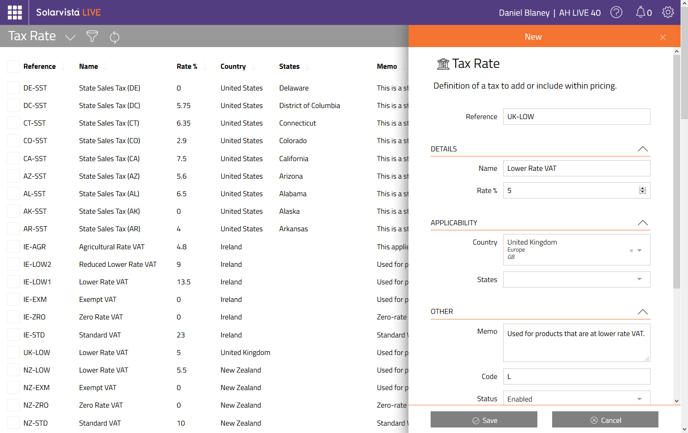

Tax Rates

A detailed look at the fields and dependencies in the Tax Rates records, how to create a new Tax Rate record & editing existing Tax Rates.

![]()

The “Tax Rate” record is used by the billing service ![]() that generates billing data and/or Invoices. Tax Rates are assigned to Customers, Products & Services to allow the computation of correct bills. Normally, this file contains ready-made records for your country of operation, however, should new tax rates become necessary, you can add your own. If you are using the billing features, it is essential to setup Tax Rates.

that generates billing data and/or Invoices. Tax Rates are assigned to Customers, Products & Services to allow the computation of correct bills. Normally, this file contains ready-made records for your country of operation, however, should new tax rates become necessary, you can add your own. If you are using the billing features, it is essential to setup Tax Rates.

Some features are dependent upon your select plan for your account.

Indicates a feature is only available in Standard plan or above.

Indicates a feature is only available in Enterprise plan.

Tax Rates are included in Lite ![]() for reference cost and sale prices only.

for reference cost and sale prices only.

Where Tax Rates Records are Used

The following files refer to Tax Rates records so if you plan to use any of these, setting up the records in this file will be important or even critical:

Data Sources:

- Customers

- Products

- Agreements

- Actions

- Invoices

Pre-requisite Files for Tax Rates Records

When setting up Tax Rates records, it is recommended to review the other data files that may need to be referred to by each record. These are the files that you may need to setup in advance:

None.

Field Descriptions for Tax Rates

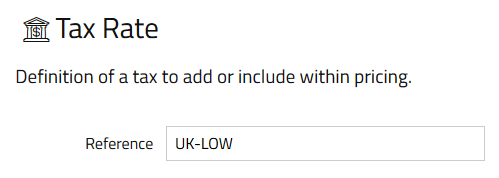

The ID section holds the unique ID and names for the record:

Reference - holds the unique ID for the record (most records in Solarvista have one of these). It cannot contain any spaces or non-standard characters. Once the record is saved, it is not possible to edit it afterwards. In most default situations, the Reference is automatically set using a counter sequence, however, you can setup your own if you prefer.

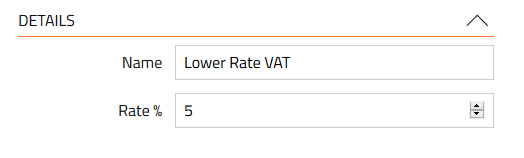

The Details section holds the detail:

Name - the formal name of the tax rate.

Rate % – the percentage tax rate.

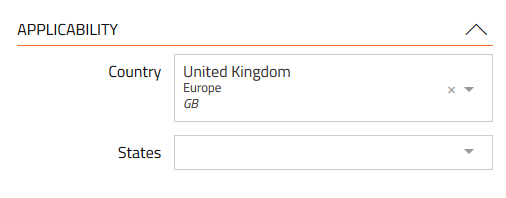

The Applicability section holds detail about where the tax rate is applicable:

Country – the country where the tax rate is applicable.

States – a list of States (subject to Country above) where the tax rate is applicable.

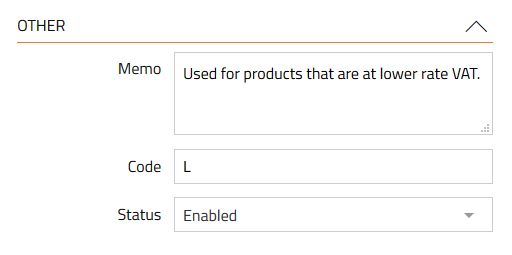

The Other section holds miscellaneous additional information:

Memo – a free text field that can be used for any purpose.

Code – used to hold an optional alternative ID code. This may be applicable in situations where information is being transferred to other systems via Connectors and the code here is used to identify the record to the other system.

Status – defines the status of the record as follows:

- Disabled – is not active. The record will not appear for selection in other parts of the system.

- Enabled – is active. The record will appear for selection in other parts of the system.

Creating a New Tax Rate Record

To create a new Tax Rate record:

- Click on the “Plus” button.

A menu will appear. - Within the “Data Sources” section, find “Tax Rate”.

- Click on “Tax Rate”.

- A new “empty” Office/Depot record will appear.

- Populate all fields as you require.

- Click on the “Create” button.

- You may need to refresh the page to see the new record in a view using the Refresh button on the top bar.

Editing a Tax Rate Record

To edit a Tax Rate record:

- From the main menu, select Tax Rates.

The default view for Tax Rates will open. - Click on the Quick Filter button.

- Enter criteria for the Tax Rate record you are looking for and click Apply button.

- The view will update. Find the record you are wanting to edit.

- Click anywhere on the row that shows the record. The record will open.

- You can edit any field that allows editing (some could be set to read only).

- Click on “Save” button to save changes.

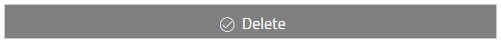

Deleting a Tax Rate Record

To delete a Tax Rate record.

- From the main menu, select Tax Rate. The default view for Tax Rate will open.

- Click on the Quick Filter button.

- Enter criteria for the Office/Depot record you are looking for and click Apply button.

- The view will update. Find the record you are wanting to delete.

- On the left side of the view is a column containing checkboxes.

- Check the box of the record you want to delete.

- Click the “Delete” button on the top right.

A slide in dialog will appear prompting you to confirm the delete, by typing in the word “DELETE” again. - To confirm, click the “Delete” button and the record (or records will be deleted).

Note: You cannot delete a Tax Rate record that is already in use with a Work Item i.e. Jobs. You can delete Tax Rate records referred to only by other Data Sources however this will leave those records without an associated to a valid Tax Rate record. If this happens by accident, you can manually recreate the record ensuring the Reference is identical. You can also change the status of the record to prevent it appearing on screen in future whilst maintaining historical integrity.

Customising or Adding New Fields

Solarvista™ LIVE is built upon Zappforms™ – a uniquely flexible platform that allows you to edit fields (or remove them in some cases) as well as add your own fields. These new fields (or edited characteristics of existing fields) automatically become available within the web portal and the mobile apps. For more information, refer to the Customising section.

Importing Cause Data in Bulk using Import Tool

If you have a lot of Cause information to enter, you may prefer to upload this using the Import Tool that’s built into Solarvista. The Import Tool enables Cause records to be created from “CSV” text files. CSV files can be created from a wide range of popular applications including Microsoft Excel. For more information on importing data into Solarvista, please refer to the article here.

Continue the Setting Up Data series with Currencies.